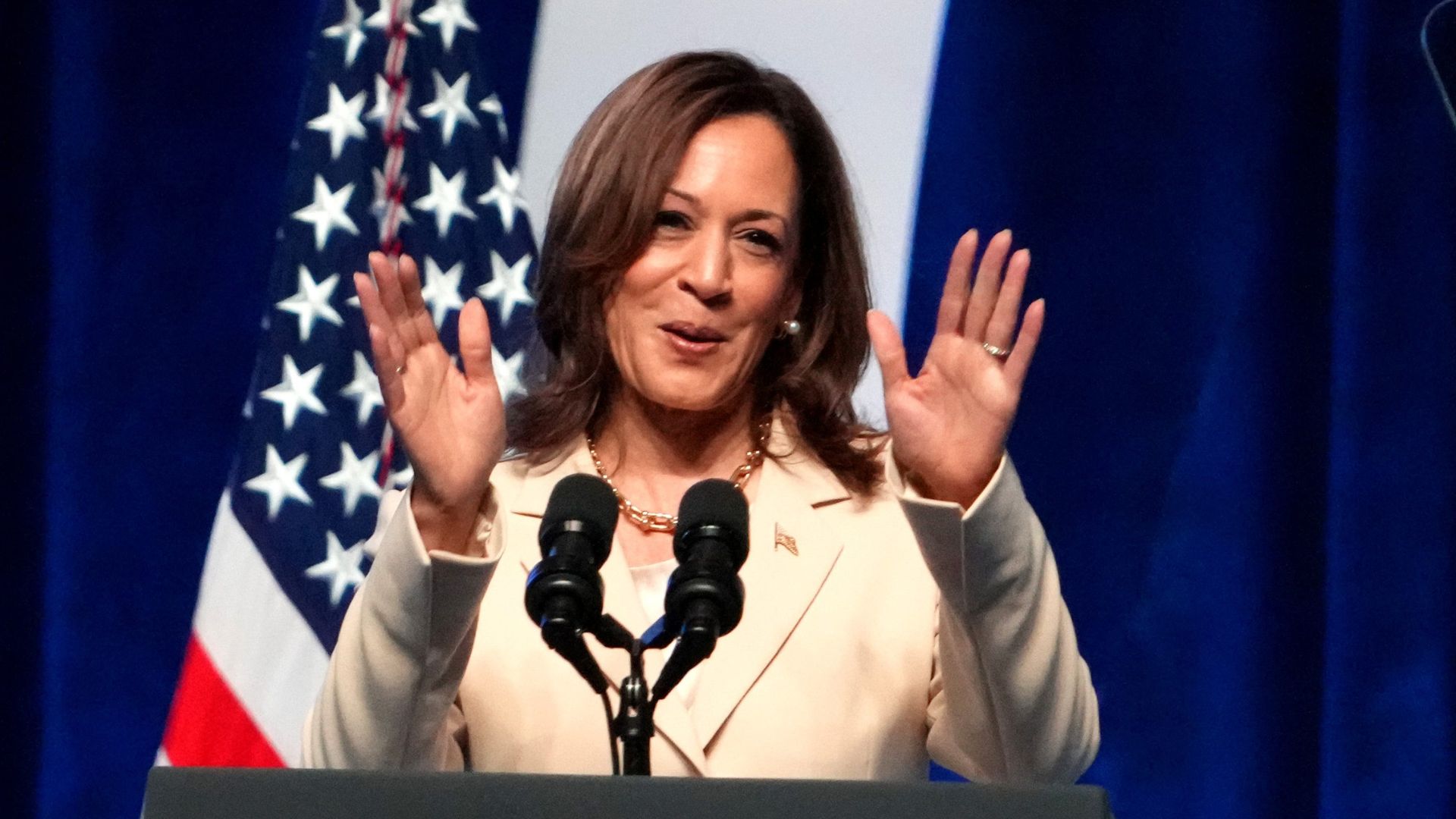

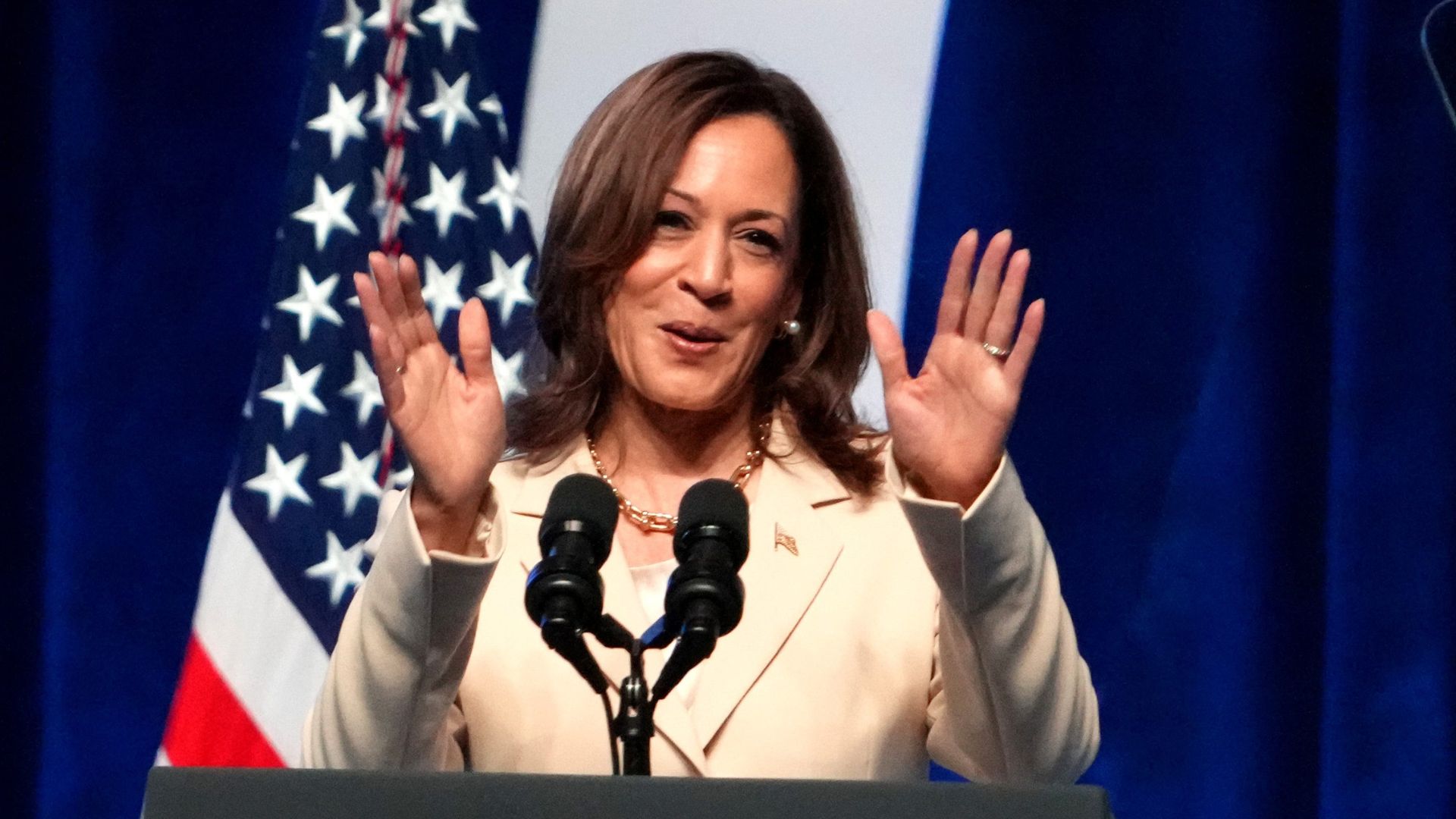

Kamala Harris is pushing a radical new tax policy that could force Americans to hand over nearly half of their profits when selling their homes.

Her latest endorsement of Joe Biden’s Fiscal Year 2025 budget proposal is a clear attempt to grab more cash from hardworking Americans.

It’s just the latest in a string of misguided economic ideas from Harris, who’s already taken heat for her stances on price controls and inflation, as reported by the Post Millenial.

Freedom-Loving Beachwear by Red Beach Nation – Save 10% With Code RVM10

According to the Wall Street Journal, the budget proposal Harris is backing would impose a staggering 44.6% tax rate on long-term capital gains if other proposed tax hikes are implemented.

This would mean that any asset held for over a year and sold for a profit could be slammed with this massive tax.

For context, the current highest capital gains tax rate is 20%, with those earning less than $492,000 annually being taxed at 15%. Harris’s plan represents an over 100% increase in capital gains taxes with very few exceptions.

Harris aims to align capital gains taxes with income tax rates for the wealthy, meaning those making over $1 million in taxable income could face this crushing 44.6% tax on gains from assets like homes and dividends.

This proposal includes a suggested increase in the general net investment income tax rate to 5%, alongside a hike in the top tax bracket to 39.6%. Both of these measures are part of the plan that Harris eagerly supports.

Yahoo Finance reports that Harris is also eyeing a reduction in the estate tax threshold, currently at $13.61 million for single filers. Tax and estate attorney David Brillant warns that if Harris wins in 2024, we can expect capital gains and estate tax rates to soar.

But it doesn’t stop there. The plan includes a 25% wealth tax for those holding over $100 million in assets.

This could affect everyday Americans with investments, particularly those who own significant shares in publicly traded companies.

If the wealth tax forces company owners to sell off large portions of their shares, it could drive down the company’s value, hitting those saving for retirement hard.

Kamala Harris Backs Unrealized Gains Tax.

Listen to @VivekGRamaswamy explain it.

28% Corporate Tax

44.6% Capital Gains Tax

25% Tax on Unrealized Gains

Price Controls

No Tax on Tips

Up to $6k Child Tax Credit pic.twitter.com/d7m8iU02b2— Truth Patriot (@Truth2Everyone) August 21, 2024

Richard Shinder, a contributor to The Hill, criticized Biden’s wealth tax proposal back in July, noting that “asset-rich, cash-poor” taxpayers might be forced to sell assets to meet their tax obligations.

Shinder warned that this could destabilize asset and capital markets. He further highlighted the risks of abuse, pointing out that IRS officials, incentivized to overestimate asset values, could exploit the wealth tax system.

This piece was written by LifeZette News Staff on August 22, 2024. It originally appeared in LifeZette and is used by permission.

Read more at LifeZette:

Walz Credits IVF for Kids-Wife Denies They Used It

Yacht Sinks: Mike Lynch, Americans Missing

Trump Campaign Calls Out False Job Growth Figures

The opinions expressed by contributors and/or content partners are their own and do not necessarily reflect the views of RVM News. Contact us for guidelines on submitting your own commentary.

Source: https://www.rvmnews.com/2024/08/biden-harris-budget-punishing-success-with-new-tax-proposals/

.